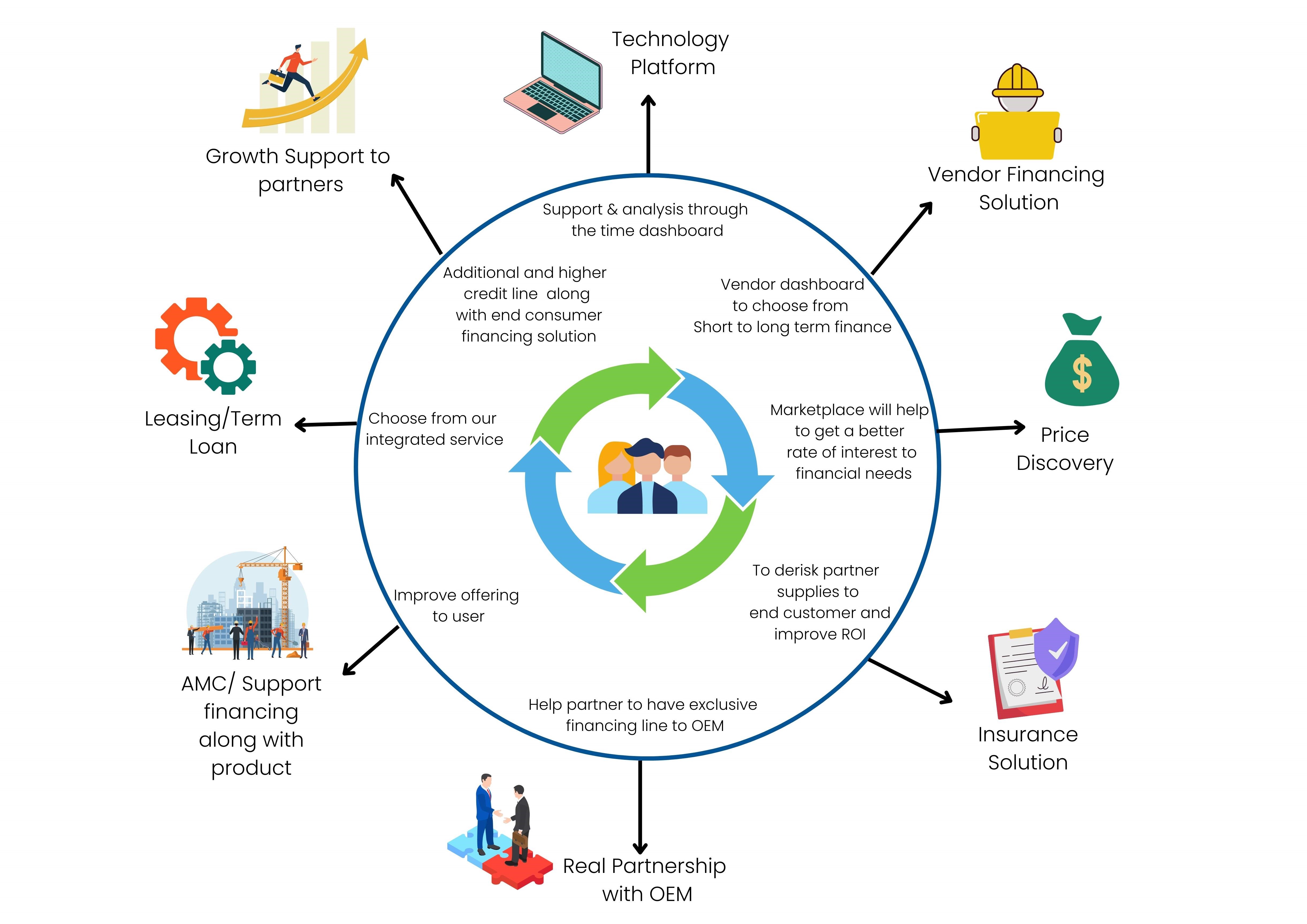

How it Works?

Our goal is to provide fast and convenient digital lending solutions for MSMEs. By connecting buyers and sellers, we aim to solve their financing problems and help them achieve their business goals. With our easy financing options, we strive to make the process as seamless as possible for all parties involved.